SanaCurrents on Kiniksa's under-the-radar play in rheumatoid arthritis | $KNSA

SUMMARY

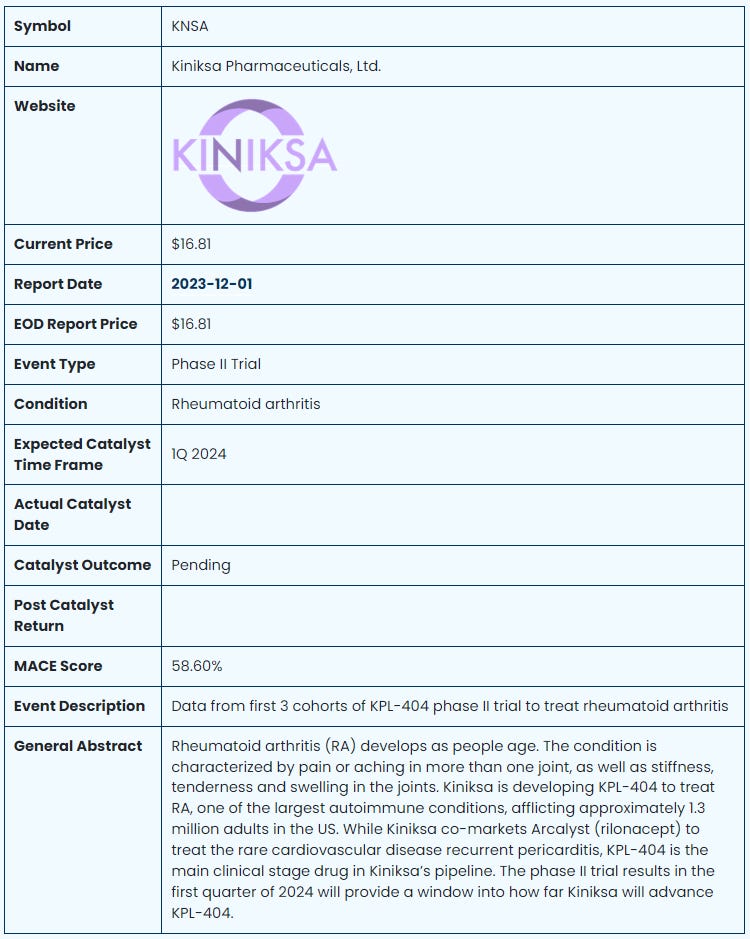

Prior to the Covid-19 pandemic, Kiniksa Pharmaceuticals, Ltd. (NASDAQ:KNSA) licensed a few advanced-stage drugs and partnered with Regeneron Pharmaceuticals (NASDAQ:RGEN) to develop Arcalyst (rilonacept) to treat recurrent pericarditis. Kiniksa’s efforts with rilonacept succeeded but Kiniksa mostly has moved on from its earlier pipeline. At the same time, it is now collecting a 50/50 split with Regeneron on Arcalyst sales.

One remaining drug in the Kiniksa pipeline is the monoclonal antibody KPL-404, now in a phase II trial to treat rheumatoid arthritis (RA). RA develops as people age. The condition is characterized by pain or aching in more than one joint, as well as stiffness, tenderness and swelling in the joints. The joint stiffness typically is more pronounced in the mornings.

Unlike approved interleukin drugs to treat RA, the human monoclonal antibody KPL-404 seeks to inhibit the CD40/CD154 co-stimulatory interaction. The drug blocks the interaction between CD40 and CD154 by binding to the CD40 receptor protein, which appears on antigen-presenting cells of the immune system. Researchers understand the CD40/CD154 interaction to play a pivotal role in many autoimmune conditions. Kiniksa is advancing KPL-404 to treat RA, one of the largest autoimmune conditions, afflicting approximately 1.3 million adults in the US.

Next Key catalysts

Data from first 3 cohorts of KPL-404 phase II trial to treat rheumatoid arthritis

Key catalyst dates

Q1 2024

Sentiment, MACE Score & The Edge….

SanaCurrents assigns a 58.6% overall probability Kiniksa will report positive phase II data for of KPL-404 to treat RA in the first quarter of next year.

The CD40 protein mediates a variety of immune and inflammatory responses. Attacking the CD40 protein directly has yielded mixed results over past two decades, primarily because of adverse reactions to the drug candidates, but few efforts has zeroed in on the CD40/CD154 ligand interaction.

In November 2023, Amgen (NASDAQ:AMGN) reported positive phase II data for dazodalibep to treat the autoimmune condition Sjögren’s syndrome. Dazodalibep is a CD40 ligand antagonist that blocks T cell interaction with CD40-expressing B cells, thereby disrupting the overactivation of the CD40 ligand co-stimulatory pathway. Amgen said the drug was generally safe and well tolerated.

With rheumatoid arthritis, Kiniksa is aiming for a much larger indication than the rare disease Sjögren’s syndrome. In a phase I trial, Kiniksa tested several doses of KPL-404. The company said a single intravenous (IV) administration of 3 mg/kg and 10 mg/kg demonstrated full CD40 receptor occupancy (RO) through Day 29 and Day 71, respectively. The paired doses also demonstrated complete suppression of the primary T-cell-dependent antibody response (TDAR) through Day 29 and suppressed TDAR to antigen rechallenge (at Day 29) through Day 43 and at least Day 57, respectively. Suppression of TDAR is a principal goal in treating autoimmune conditions.

In the KPL-404 phase II trial, the company’s investigators will examine the incidence of treatment-emergent adverse events (TEAEs) in cohorts 1 and 2. In cohort 3, investigators will assess the change in baseline in the disease activity score (DAS) of 28 joints based on measures of c-reactive protein (CRP) at week 12. Cohort 4 in the phase II trial, expected to enroll about 130 patients, also will make the same assessment (DAS28-CRP) but Kiniksa said it plans to only report data on cohorts 1-3 in the first quarter. The primary endpoint in cohort 4 is the change from baseline in DAS28-CRP at week 12, not TEAEs as in cohorts 1 and 2.

THE EDGE

Kiniksa reported $64.8 million in net product revenue for Arcalyst in the third quarter of 2023, representing a 94% year-over-year growth for its only drug.

While the company’s “launch” of Arcalyst, with Regeneron, has proved successful, Kiniksa is not advancing a pipeline of drugs around a broad scientific platform. Though the company claims to be evaluating mavrilimumab for development in rare cardiovascular diseases, following the drug’s mixed results in giant cell arteritis, its pipeline mostly revolves around KPL-404 and its potential in autoimmune conditions. Accordingly, the company’s next steps, other than a buyout in an M&A market expected to heat up in 2024, will center around KPL-404.

The strong safety data for KPL-404 in phase I likely convinced the company to move forward in RA. The first three cohorts will deliver a peek into the potential of KPL-404.

For a $145 billion market cap company like Amgen, the phase II data for dazodalibep in Sjögren’s syndrome was not a significant catalyst. For Kiniksa, with a market cap of $1.2 billion, a glimpse of potential efficacy with KPL-404 can be significant. The measured steps by Kiniksa to advance KPL-404 signal the potential will be revealed.

Disclosure:

SanaCurrents is initiating coverage and a position in KNSA. SanaCurrents may close its position in KNSA prior to or following the expected catalyst date.