SanaCurrents on Ocular's long-term implant to treat NPDR and wet AMD | $OCUL

SUMMARY

The market for new treatments for “back of the eye” diseases surged in recent years, driven in part by the need to move beyond injections required to be administered every 4-8 weeks. Ocular Therapeutix, Inc. (NASDAQ:OCUL), a nearly 20-year-old company, develops drugs for eye diseases based on its Elutyx bioresorbable hydrogel-based formulation technology. While it has two drugs on the market, the company attracted a $325 million private placement on February 22 based on advancing Axpaxli (axitinib intravitreal implant) to treat wet age-related macular degeneration (wet AMD).

Axpaxli offers the promise of a longer-term implant to treat wet AMD by a class of drugs, tyrosine kinase inhibitors (TKIs), which appear to be as effective as approved anti-VEGF drugs. If Axpaxli proves to be successful in its phase III SOL-1 trial in wet AMD, Ocular quickly could entrench Axpaxli as a later-generation wet AMD treatment. The relief to patients and the cost savings to payers would be considerable. Data from the pivotal Sol-1 trial will not be available until next year but Ocular will present a peek at how Axpaxli works when it releases data in the next quarter from a phase I trial, named Helios, testing the implant as a treatment for non-proliferative diabetic retinopathy (NPDR).

Key catalysts

Data from phase I Helios trial testing Axpaxli (axitinib intravitreal implant) to treat non-proliferative diabetic retinopathy (NPDR)

Key catalyst dates

Q2 2024

Sentiment, MACE Score & The Edge….

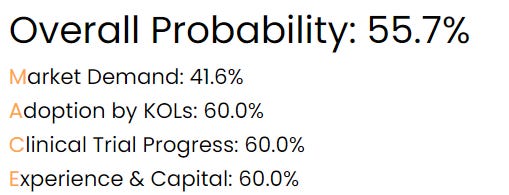

SanaCurrents assigns a 55.7% overall probability Ocular will report positive data from the Helios trial in the second quarter of 2024.

Wet AMD accounts for 90% of the legal blindness that results in AMD patients without treatment. Accordingly, five significant drugs have been approved to treat wet AMD. In contrast, proliferative diabetic retinopathy is treated only in moderately severe and severe cases; the standard of care now for non-proliferative diabetic retinopathy (NPDR), or stage 1, is generally physician observation. NPDR, however, significantly increases the risk of patients advancing to both wet and dry AMD, explaining how and why Ocular is linking Axpaxli to treating both conditions. Ocular likely first would target the 3.3 million moderate-to-severe NPDR patients in the US, though a further opportunity may exist in mild NPDR.

In the US-based, double-masked Helios trial, investigators will randomize 22 subjects 2:1 to receive either a single implant of Axpaxli containing 600 µg of axitinib or a sham control. Safety is the primary endpoint but investigators also assess the change in best corrected visual acuity [BCVA] in Axpaxli subjects compared to the sham control. The assessment will help demonstrate Axpaxli’s effectiveness in treating a retinal disease.

THE EDGE

Axpaxli’s biggest boost came in January 2024 when the FDA agreed to modify a special protocol assessment for Axpaxli in the SOL-1 trial in wet AMD. The SPA modification enables the trial to include treatment-naïve wet AMD subjects with visual acuity of approximately 20/80 or better at the initial screening visit. Significantly, the modification will enable Ocular to recruit patients faster for the 300-subject trial. It also should provide the company with more patient data relating to NPDR.

Axpaxli will face competition in wet AMD, less so in NPDR. The AMD market, however, is proving exceedingly robust and continues to expand. Vabysmo, a Roche Holding AG (OTC:RHHBY) drug to treat AMD and diabetic macular edema, tripled sales in 2023 to $2.76 billion after first being approved in January 2022. The sales figure was 3.9% higher than the consensus expectation by analysts. Vabysmo grabbed 22% of US market share in the age-related macular degeneration market and 15% in diabetic macular edema. Nearly 1,000 retinal specialists who never used a Roche drug now regularly prescribe Vabysmo, according to the company.

The strong launch of Vabysmo demonstrates how many AMD patients remain untreated. Ocular wants to position Axpaxli as an implant that can release the drug for an extended period of time of more than 9 months. In a 15-patient phase I trial of Axpaxli, 9 of the 15 were rescue free from standard therapy for 12 months. Axpaxli will have to repeat that standard in the SOL-1 trial to be competitive with the likes of Roche and Regeneron (NASDAQ:REGN), as well as demonstrating non-inferiority to current treatments in BCVA.

A significant test for Axpaxli comes in the Helios trial in NPDR. The NPDR market is expected to grow to $13.2 billion by 2030. Ocular owns two clean shots to advance Axpaxli. The first pivotal answer likely will come between April 5 and 8 at the American Society of Cataract and Refractive Surgery meeting.

Disclosure:

SanaCurrents, the parent of BioCurrents, is initiating coverage and a position in OCUL. SanaCurrents may close its position in OCUL prior to or following the expected catalyst date.